Eco-Friendly Homes with Mortgages: What the Market Has to Offer

Eco-conscious homes used to be a luxury for the few. Now, they’re steadily becoming part of the mainstream housing conversation. Rising utility costs, climate anxiety, and stricter building regulations are all pushing both buyers and lenders toward sustainable real estate. If you’re shopping for a home or planning renovations, you’ve probably seen the term “green mortgage” or some kind of incentive tied to energy performance. But what does that actually mean in practice? And how do mortgages support eco-upgrades in real life — not just on paper?

What Actually Counts as an Eco-Friendly Home?

Lender Expectations vs. Popular Perception

To a lender, “eco-friendly” isn’t about whether the home has plants on the balcony or recycled wood in the kitchen. It’s about measurable efficiency. Most financial institutions focus on properties with reduced energy consumption, lower carbon emissions, and certified building materials or systems. This often means homes that come with formal ratings or certifications — like an Energy Performance Certificate (EPC) of A or B, or labels from green building programs like LEED, BREEAM, or Passivhaus.

Common Green Features That Increase Eligibility

| Feature | Benefit |

|---|---|

| Solar Panels | Reduce electricity costs, increase energy independence |

| Triple-Glazed Windows | Limit heat loss, improve comfort, lower HVAC usage |

| Smart Thermostats | Optimize heating and cooling cycles for efficiency |

| Green Roofs | Enhance insulation, absorb stormwater runoff |

| Efficient Heat Pumps | Replace gas boilers with cleaner heating systems |

These upgrades aren’t always cheap, but they’re exactly the type that lenders reward when reviewing green mortgage applications.

How Green Mortgages Work in Real Life

They Aren’t Different Loans — Just Different Terms

A green mortgage is still a standard home loan, but with added perks. These perks kick in when your property meets certain energy criteria. Instead of changing the loan type entirely, banks and credit providers tweak the interest rate, add cashback options, or improve the loan-to-value ratio for qualifying borrowers. In other words, you get rewarded for choosing (or upgrading to) a more energy-efficient home.

Types of Incentives Currently Available

| Lender Type | Green Incentive |

|---|---|

| Major Banks | Discounted interest rates for homes with EPC A or B |

| Online Lenders | Faster loan approvals for green-certified buildings |

| Credit Unions | Cashback for sustainable retrofits (windows, insulation) |

| Public Programs | Grants, lower insurance, or tax benefits linked to energy performance |

Some lenders also offer extra funds as part of the mortgage, specifically earmarked for eco renovations. These might include installing solar panels, replacing heating systems, or adding external wall insulation — all without needing a second loan.

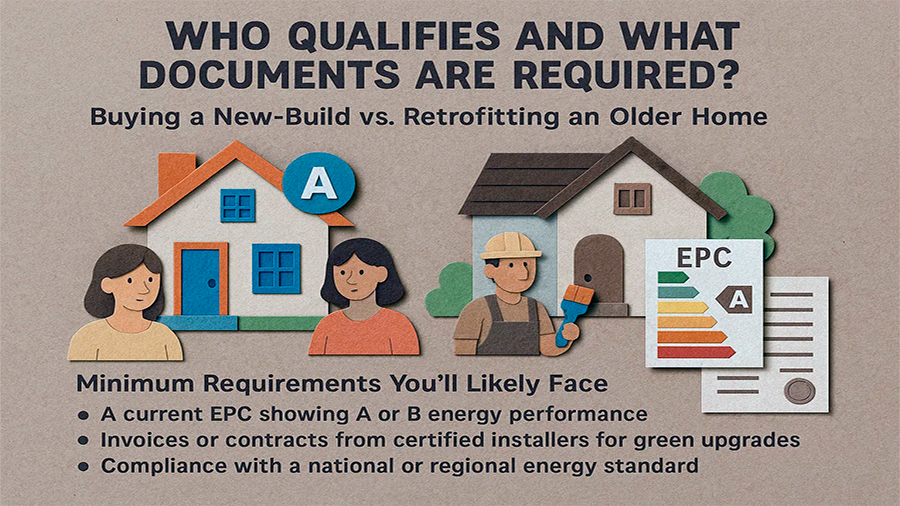

Who Qualifies and What Documents Are Required?

Buying a New-Build vs. Retrofitting an Older Home

It’s much easier to qualify for a green mortgage when you’re buying a new property that already meets modern energy standards. Many developers now advertise A-rated EPCs as a key selling point. For older homes, however, borrowers must commit to renovations that improve efficiency — and provide documentation to prove it. Sometimes the benefits are approved after upgrades are completed and verified; other times, the mortgage includes pre-approved funds for the work.

Minimum Requirements You’ll Likely Face

- A current EPC showing A or B energy performance

- Invoices or contracts from certified installers for green upgrades

- Compliance with a national or regional energy standard

Each lender has its own interpretation of “green.” That’s why it’s essential to read the fine print and ask specifically what they require — before making financial decisions.

What Are the Real Savings Over Time?

Monthly Utility Costs Drop Significantly

The savings from an eco-home don’t just come from the mortgage. Monthly heating, cooling, and electricity bills can fall by 30–60% depending on how green the home is. That adds up. Especially over a 20- or 30-year loan term, the reduced utility expenses make a noticeable impact on your total homeownership costs.

Efficiency vs. Utility Cost

| Efficiency Level | Monthly Utility Cost | Estimated Savings |

|---|---|---|

| Standard Home | €200 | – |

| Partially Upgraded | €140 | €60 |

| Fully Green Certified | €90 | €110 |

If you’re paying €90/month instead of €200, that’s nearly €1,300 in annual savings — more than enough to offset modest renovation loans or closing costs. Combine that with mortgage perks, and the value becomes more than symbolic.

Risks, Trade-Offs, and Considerations

Initial Costs Can Be High

There’s no avoiding it: going green isn’t cheap. Even with cashback and grants, upfront investment can run high. A solar panel system might cost €10,000. A heat pump system could be similar. If you’re financing these through your mortgage, you’re spreading the cost over time — but paying interest on top. That changes the return-on-investment calculation.

Be Wary of “Greenwashing” Offers

Some mortgage offers use “eco” language as a marketing hook. Read the details. If there’s no measurable benefit for verified energy performance, it’s not a green mortgage — it’s just branding. The same goes for renovations: cosmetic upgrades don’t count. It has to result in lower consumption, or it won’t qualify you for any financial advantage.

The Direction the Market Is Heading

More Automation, Less Guesswork

Some banks are testing AI tools that instantly analyze a property’s energy profile and suggest financing packages. This kind of automation could help buyers and agents see the true cost of ownership — not just the list price. Expect to see EPCs integrated into loan calculators and approval systems more routinely in the coming years.

Regulatory Pressure Is Driving Change

Governments across Europe are pushing lenders to reduce emissions linked to housing. Some programs already tie bank performance to the carbon footprint of their loan books. That means more banks will be forced to prioritize green loans — not just offer them as an option. As a result, eco-friendly borrowers may gain even more leverage in the mortgage market.

The Bottom Line

Eco-friendly homes backed by smart mortgage options are no longer out of reach. In fact, they’re becoming one of the smartest long-term choices a homeowner can make — both financially and environmentally. You might pay more upfront, but between energy savings, better resale value, and lender incentives, the return is very real. The key is transparency: know your home’s energy profile, read your mortgage offer closely, and run the numbers before you commit. Done right, your green investment can pay dividends — in your wallet and in your future.